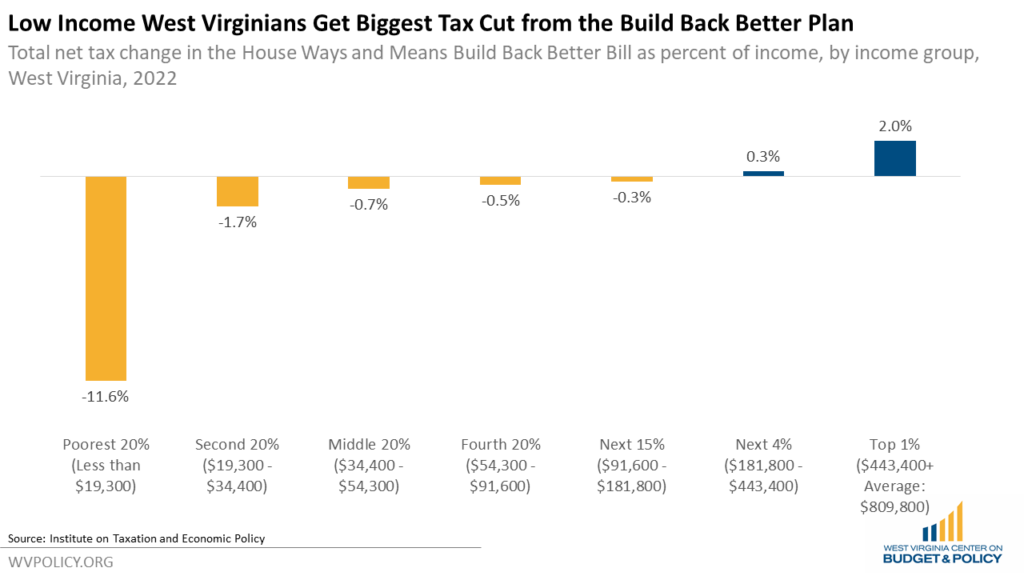

The Build Back Better Tax Plan Broadly Benefits All But the Very Wealthiest West Virginians - West Virginia Center on Budget & Policy

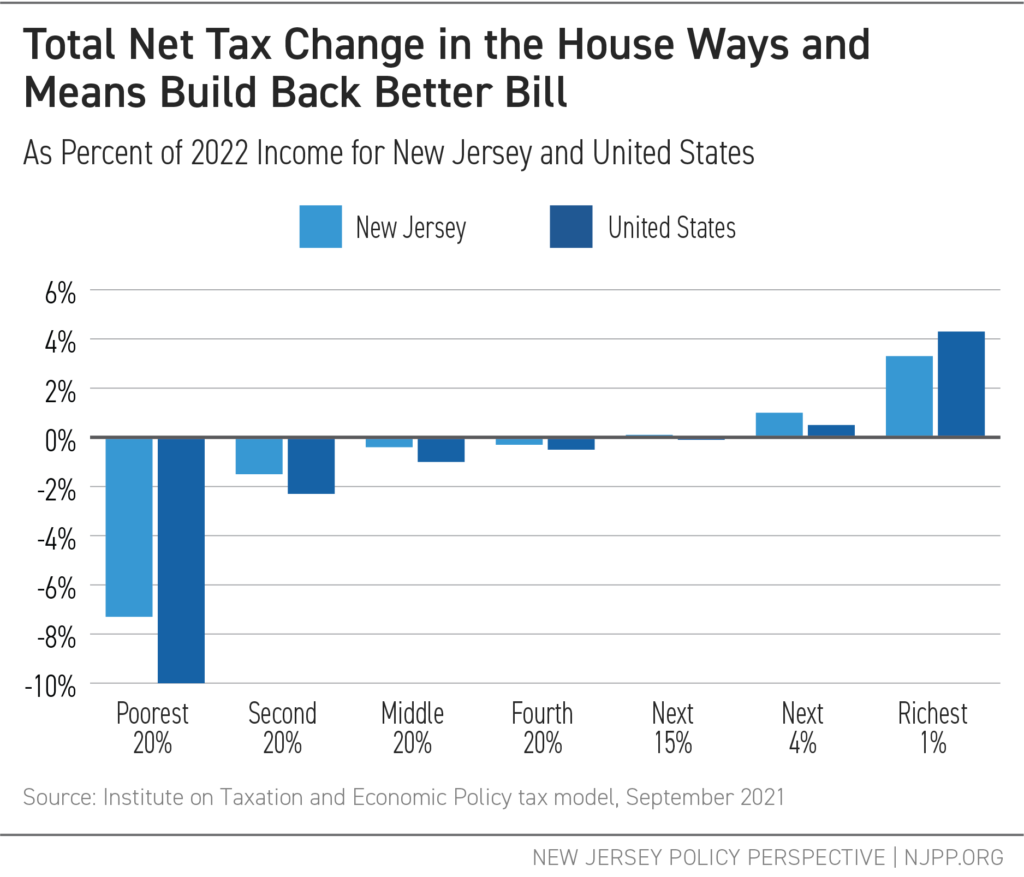

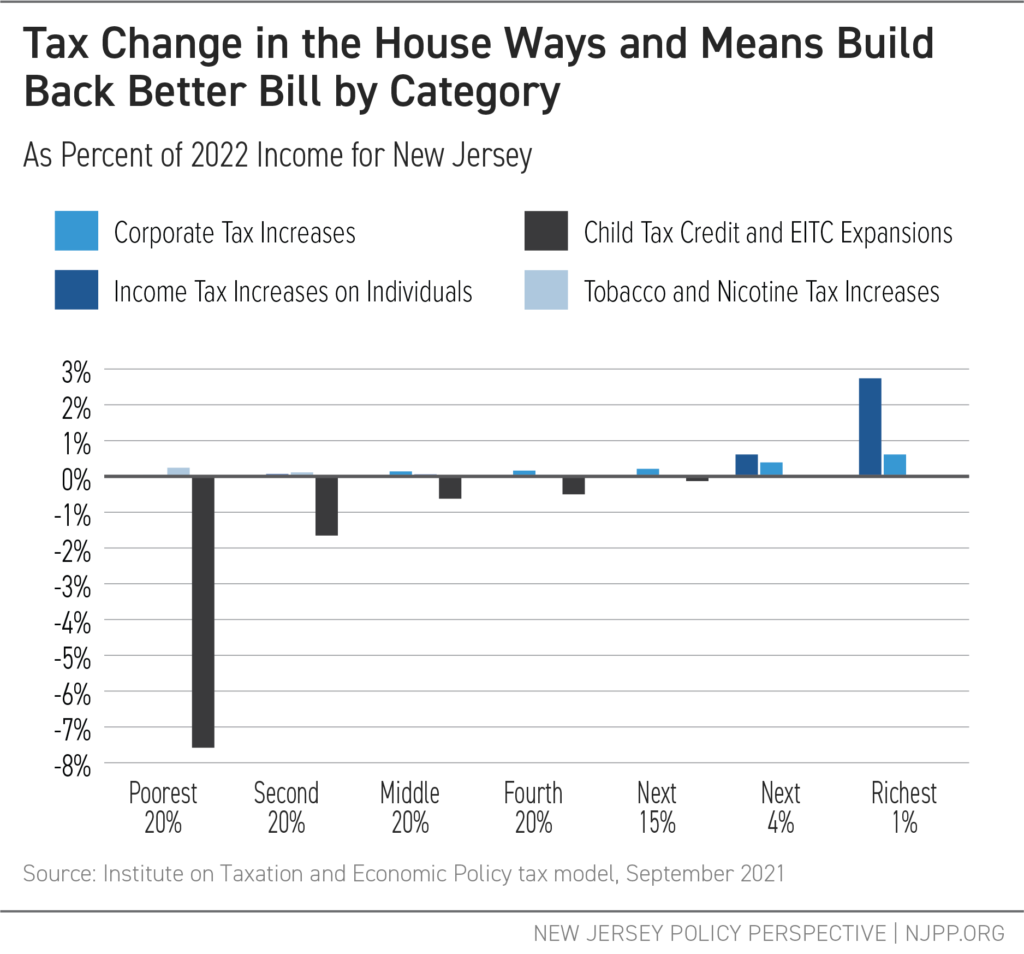

Build Back Better Legislation Makes the Tax Code Fairer — But Only if SALT Cap Stays in Place - New Jersey Policy Perspective

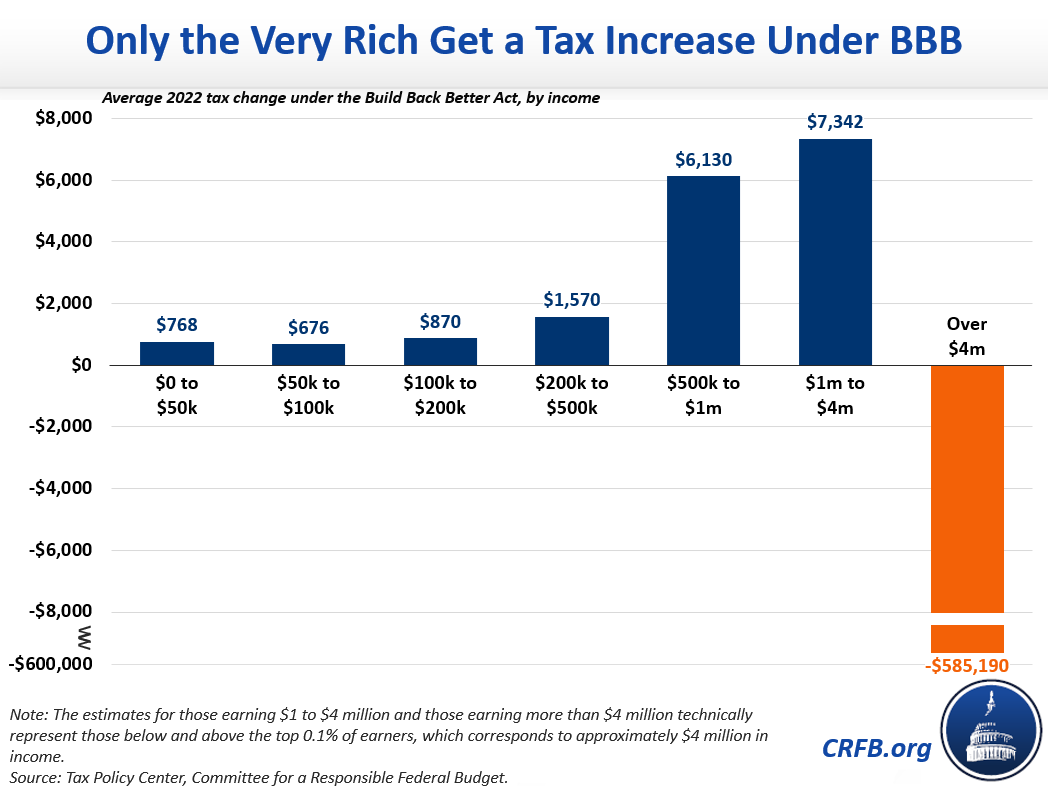

Build Back Better 2.0 Still Raises Taxes For High Income Households And Reduces Them For Others | Tax Policy Center

Build Back Better Legislation Makes the Tax Code Fairer — But Only if SALT Cap Stays in Place - New Jersey Policy Perspective

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22928612/Screen_Shot_2021_10_14_at_9.35.46_AM__1___1_.png)